Market Returns During Election Years

As the U.S. presidential elections approach, many investors wonder how the outcome might influence the stock market. While this anticipation is understandable, historical data reveals a more nuanced picture. Examining nearly a century’s worth of market performance during election months and presidential terms, it becomes clear that the stock market’s behavior is influenced by a multitude of factors, with elections being just one piece of the puzzle.

Election Months and Stock Market Behavior

Data from 1926 to 2023 shows that stock market returns during election months do not exhibit consistent patterns. The S&P 500 index, when analyzed for these months, does not favor significant gains or losses solely based on the election outcome. Interestingly, the winning party, whether Democrat or Republican, hasn’t been a reliable predictor of market direction or magnitude of change during these periods. This suggests that investors should focus on their long-term strategies rather than making decisions based on election results. [1]

[1] Dimensional Fund Advisors. (2023). How US Stocks Have Behaved in an Election Month. [JPG].

Presidential Terms and Long-Term Market Growth

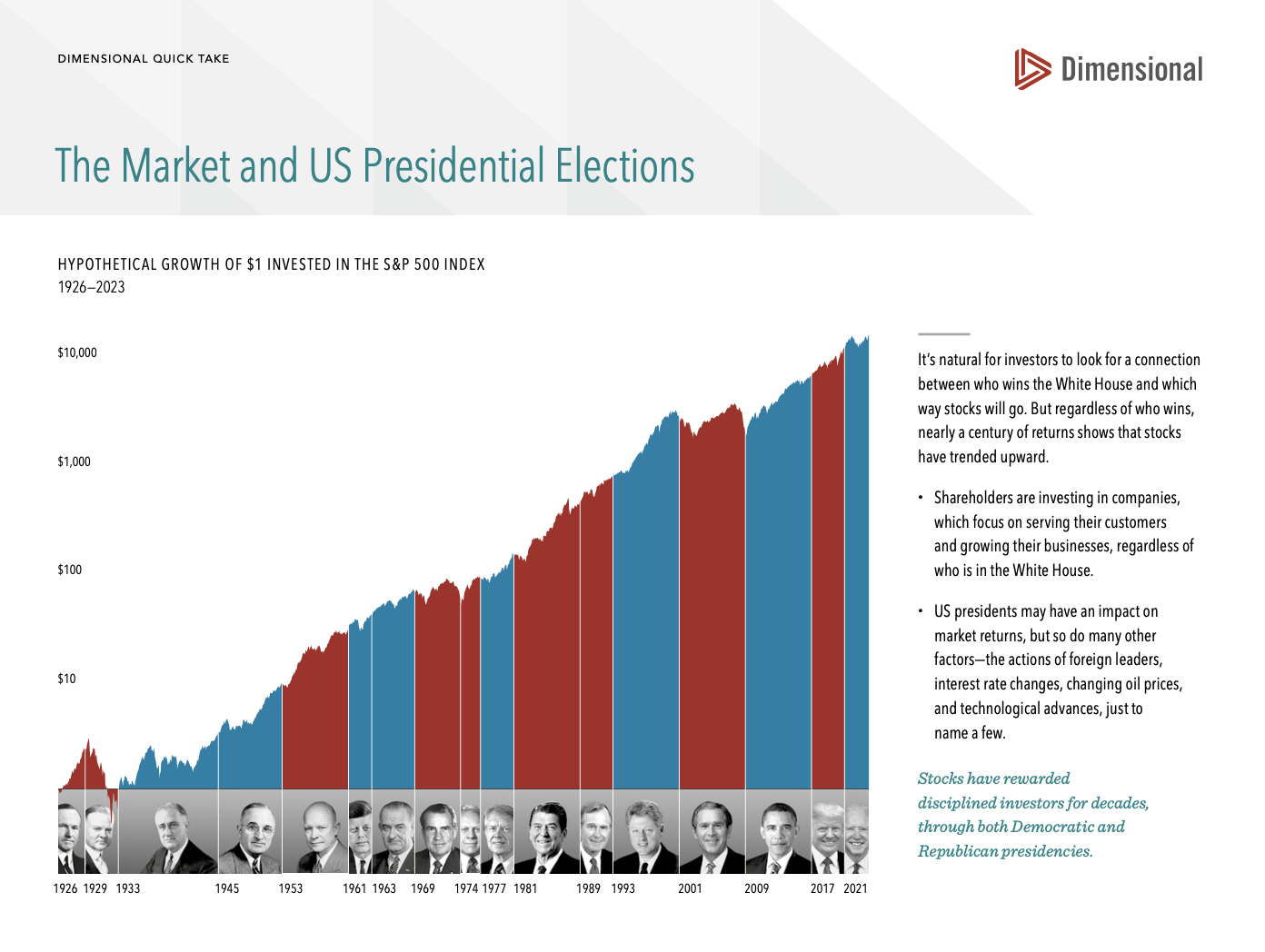

An analysis of U.S. presidential terms from 1928 to 2022 reveals a striking fact: the stock market has maintained a consistent upward trajectory, regardless of the party in power. This long-term growth is a testament to the market's resilience and underscores the benefits of a steadfast investment approach. For instance, the growth of $100 invested in the market shows substantial increases over decades, surviving various political climates and economic conditions. This should instill confidence in investors and reaffirm the market’s ability to weather storms and continue their upward trend. [2]

Key Insights from Presidential Impact on Stocks

The detailed examination of each presidency reveals that market performance is more closely tied to broader economic policies and global events rather than the individual actions of presidents. Factors like GDP growth, inflation, and unemployment rates during each term provide a clearer picture of economic health rather than attributing market performance solely to presidential influence. Historical data supports the notion that while presidents can influence certain economic policies, the market’s long-term performance is driven by a broader set of factors. [2]

[3] Dimensional Fund Advisors. (2023). Market and US Presidential Elections. [JPG]

In conclusion, while presidential elections and the resulting administrations do play a role in shaping economic policies, investors should recognize that the stock market’s long-term growth is influenced by a wide range of factors. Maintaining a disciplined investment strategy and focusing on long-term goals is often the best approach, rather than reacting to short-term political changes. As history shows, the market has a remarkable ability to adapt and grow regardless of the political landscape.

For an in-depth analysis and detailed historical data, click below to read the full reports from our partners at Buckingham, or watch the video for additional insights.

Ready to navigate the market with confidence? Schedule a call with Nora Wealth today and secure your financial future!

[1] Dimensional Fund Advisors. (2023). How US Stocks Have Behaved in an Election Month. [JPG].

[2] Dimensional Fund Advisors. (2023). How Much Impact Does the President Have on Stocks? [PDF].

[3] Dimensional Fund Advisors. (2023). Market and US Presidential Elections. [JPG]

[4] Dimensional Fund Advisors. (2023). Market Returns During Election Years [PPX]